Cash App: Recurring Payments

Overview

Cash is an application available in the United States that allows users to send peer to peer payments. Other features include the ability to pay businesses, purchase Bitcoin, and purchase stock shares. People who send or receive payments via the Cash application sometimes require those payments to be recurring, e.g. payments for services, rent, share utilities, etc. There is currently no way to set up recurring payments in the app. In this fictional brief, we will explore adding this feature.

What we did

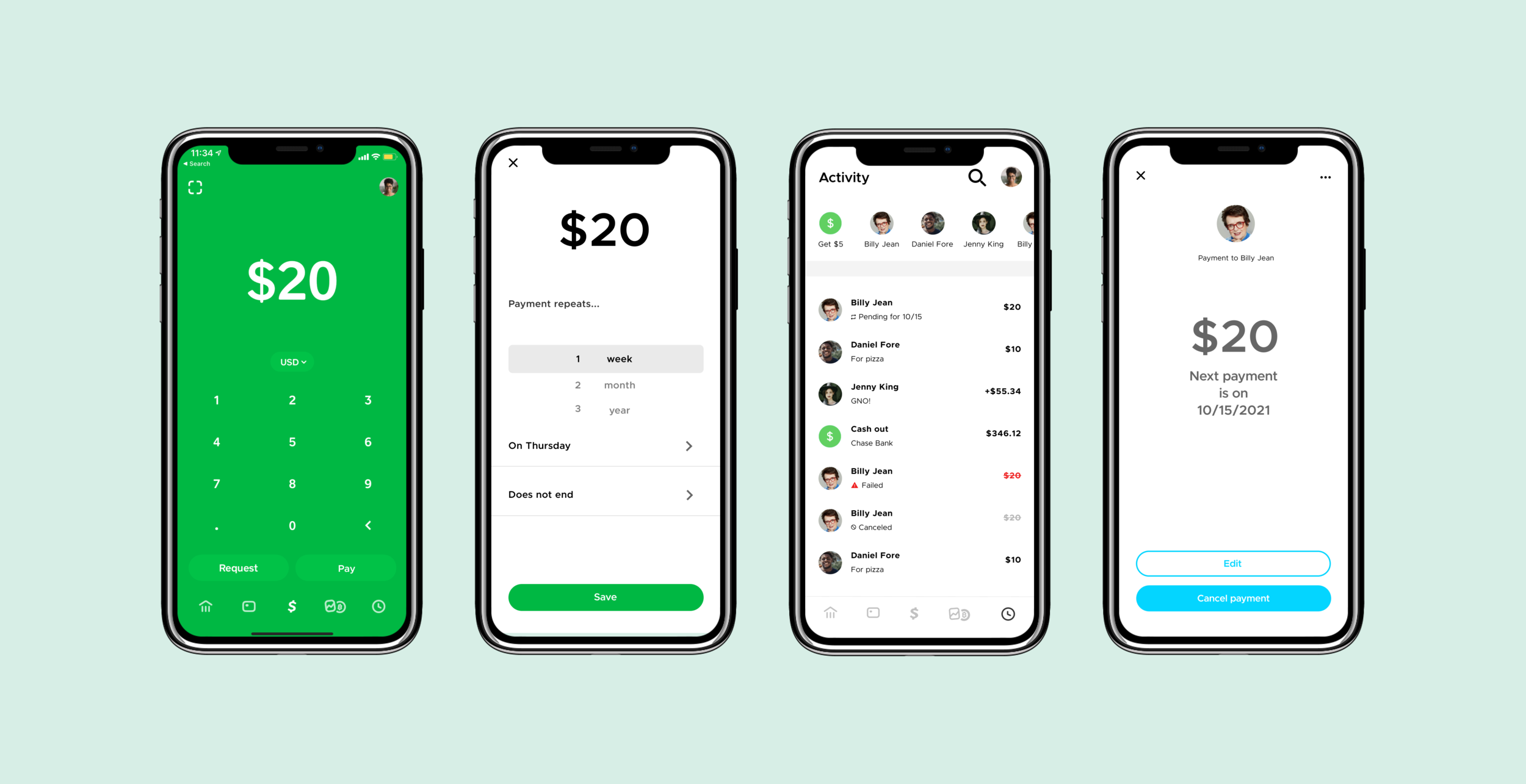

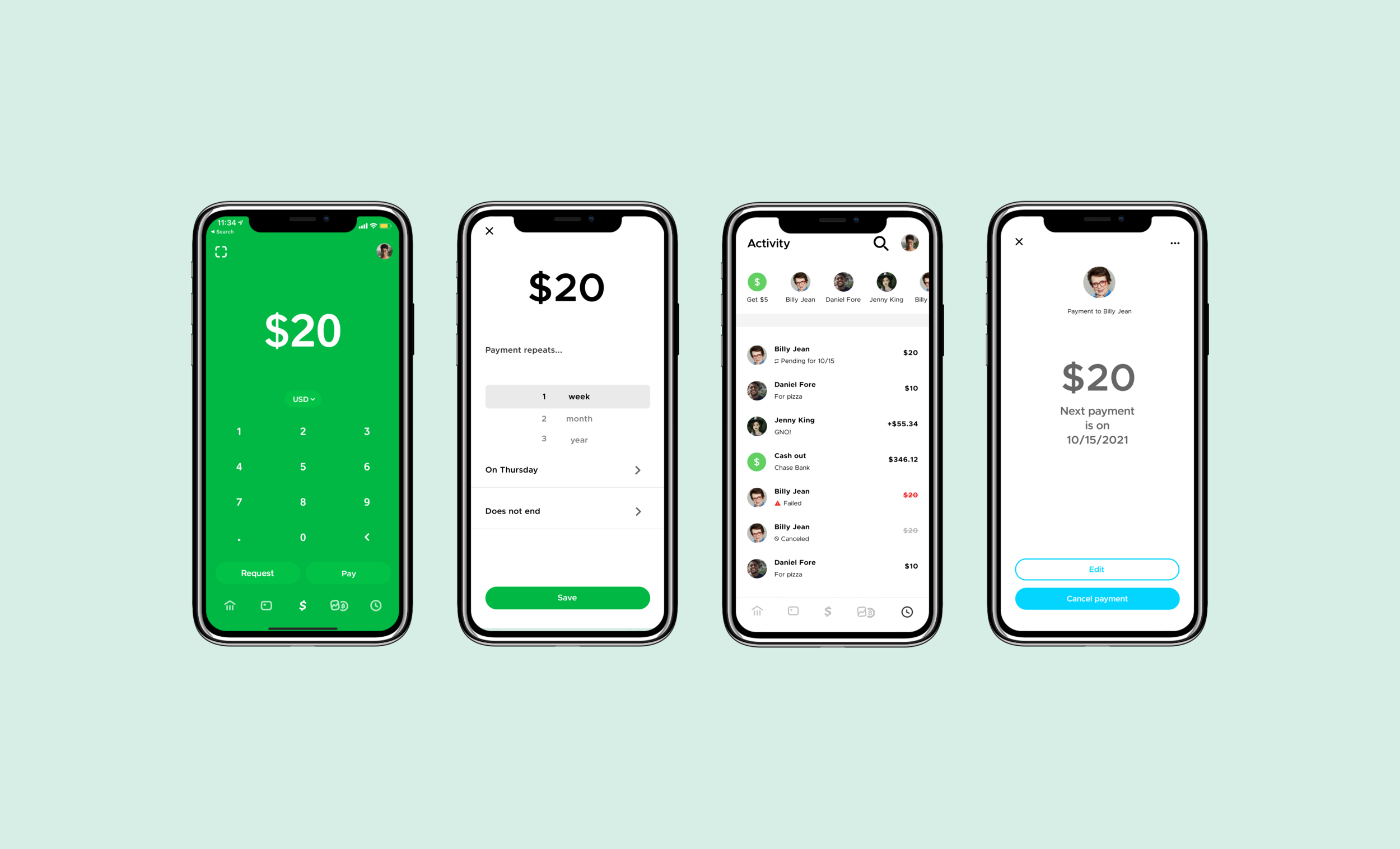

We added features to allow users to set up and schedule a recurring payment, edit payments, and skip or cancel specific payments. Explore the prototype here.

Role

Solo designer: Market and user research, wireframing, visual design, and user testing

Research & Findings

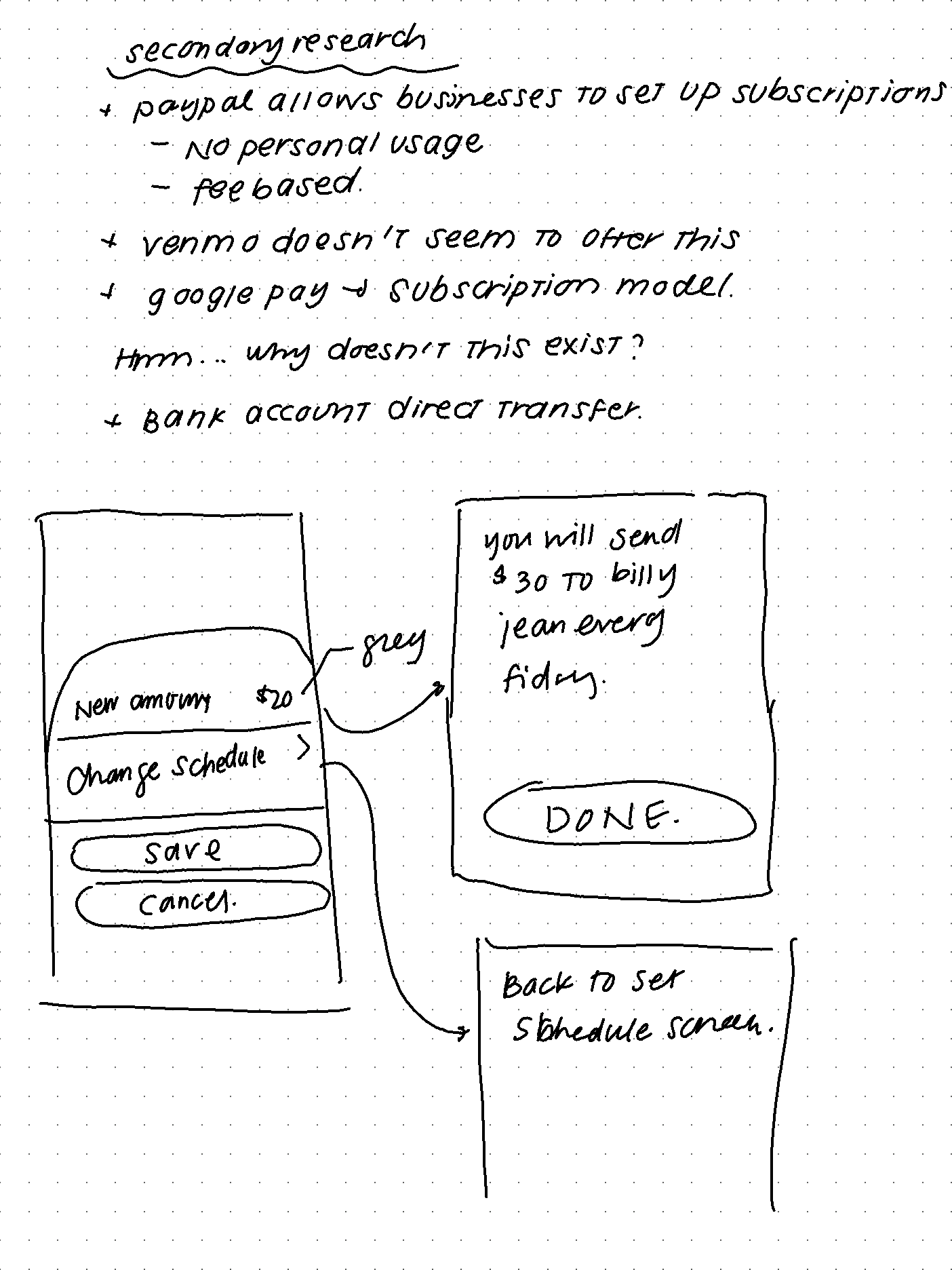

Secondary Research

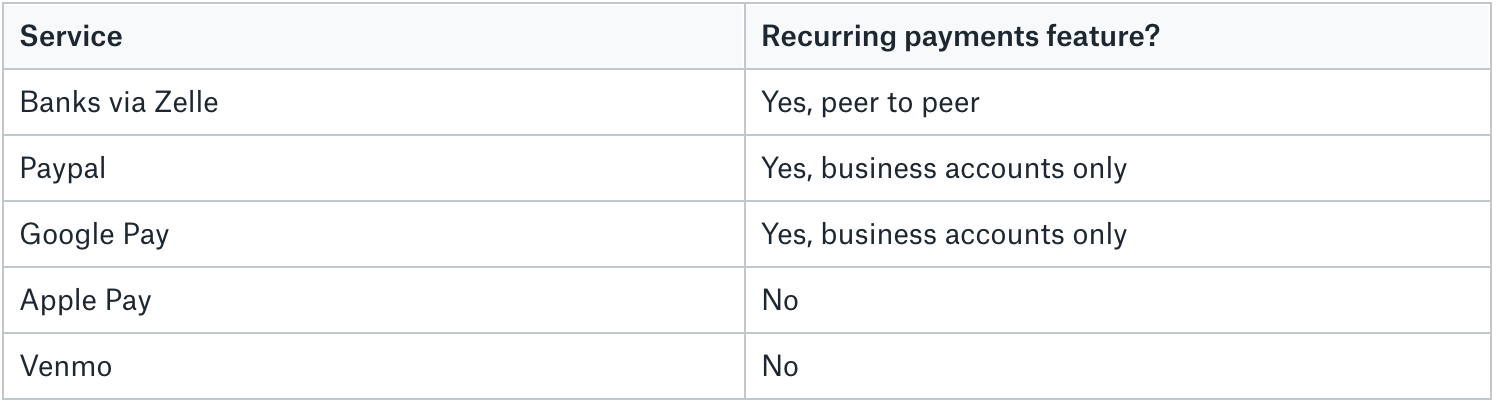

There are many services that enable peer to peer payments within the US:

Out of all the options, only banks allowed for peer to peer recurring payments. Banks integrated with Zelle allowed users to set up recurring payments. Withdrawals are made via ACH directly on a user’s bank account. Paypal and Google Pay allowed for recurring payments under a subscriptions product, but users would need to have a business account and would pay a per transaction fee between 1.9% to 2.9%.

Peer to peer recurring payments are an often requested feature. A brief search showed users requesting this feature as far back as 2013. What makes Cash app a compelling competitor to Zelle’s services?

There are risks to using Zelle as there’s not a lot of protection on bank accounts. Requirement is that someone have a bank account while Cash serves the underbanked.

More people are using Cash as a one stop shop for their financial activity, including BTC, stocks, and banking.

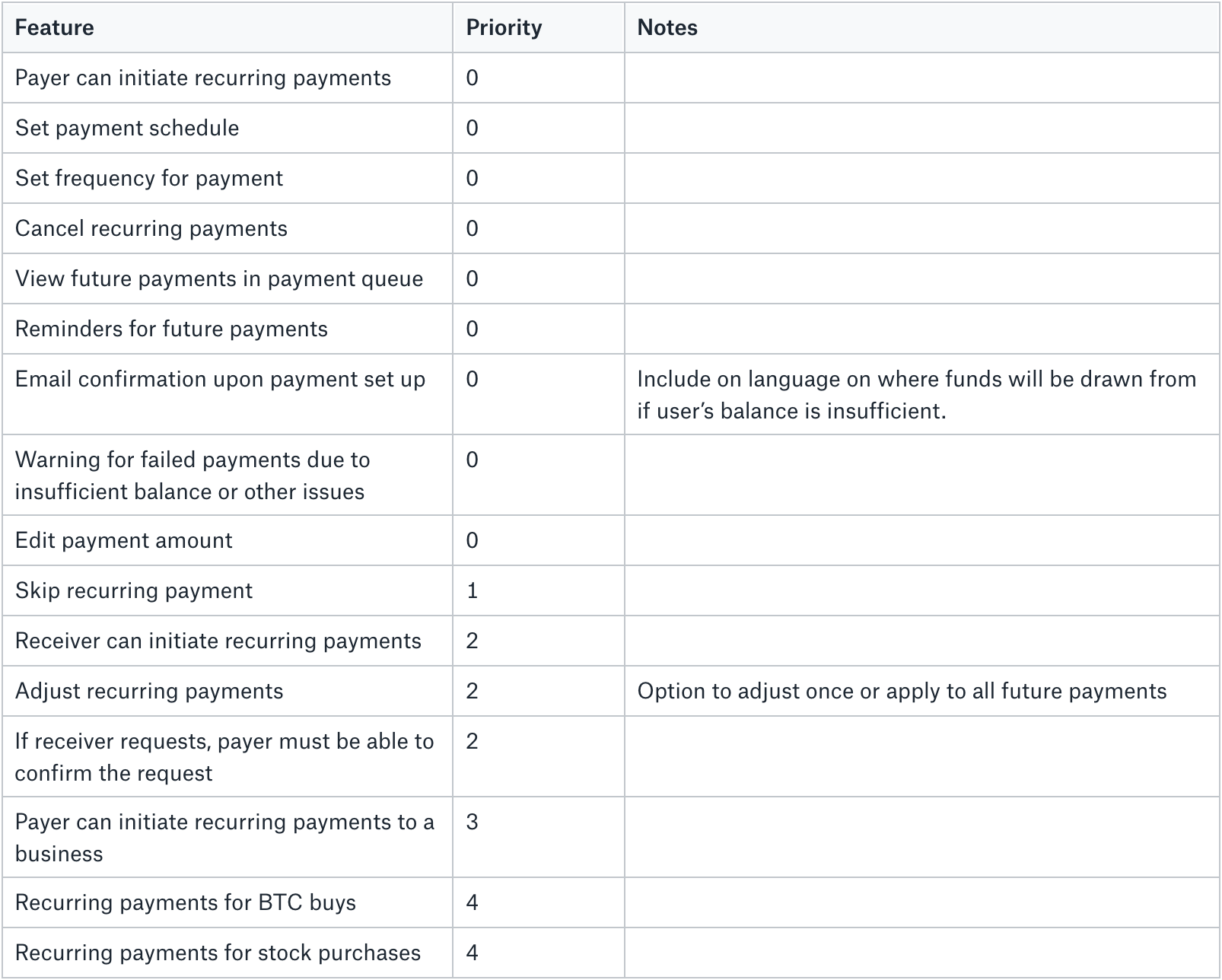

Product Roadmap

The following is a roadmap for product features ordered by priority. For this project, we focused on priority 0 items. While I did not get a chance to explore the P1 through P4 features, I included them as interesting points to consider in the expansion of the product.

Task Flows

I chose to use a task flow to map out how a user would step through the distinctive steps of setting up a recurring payment, changing a recurring payment, and handling certain edge cases. These task flows will define the wireframes I need to create and the user testing needed.

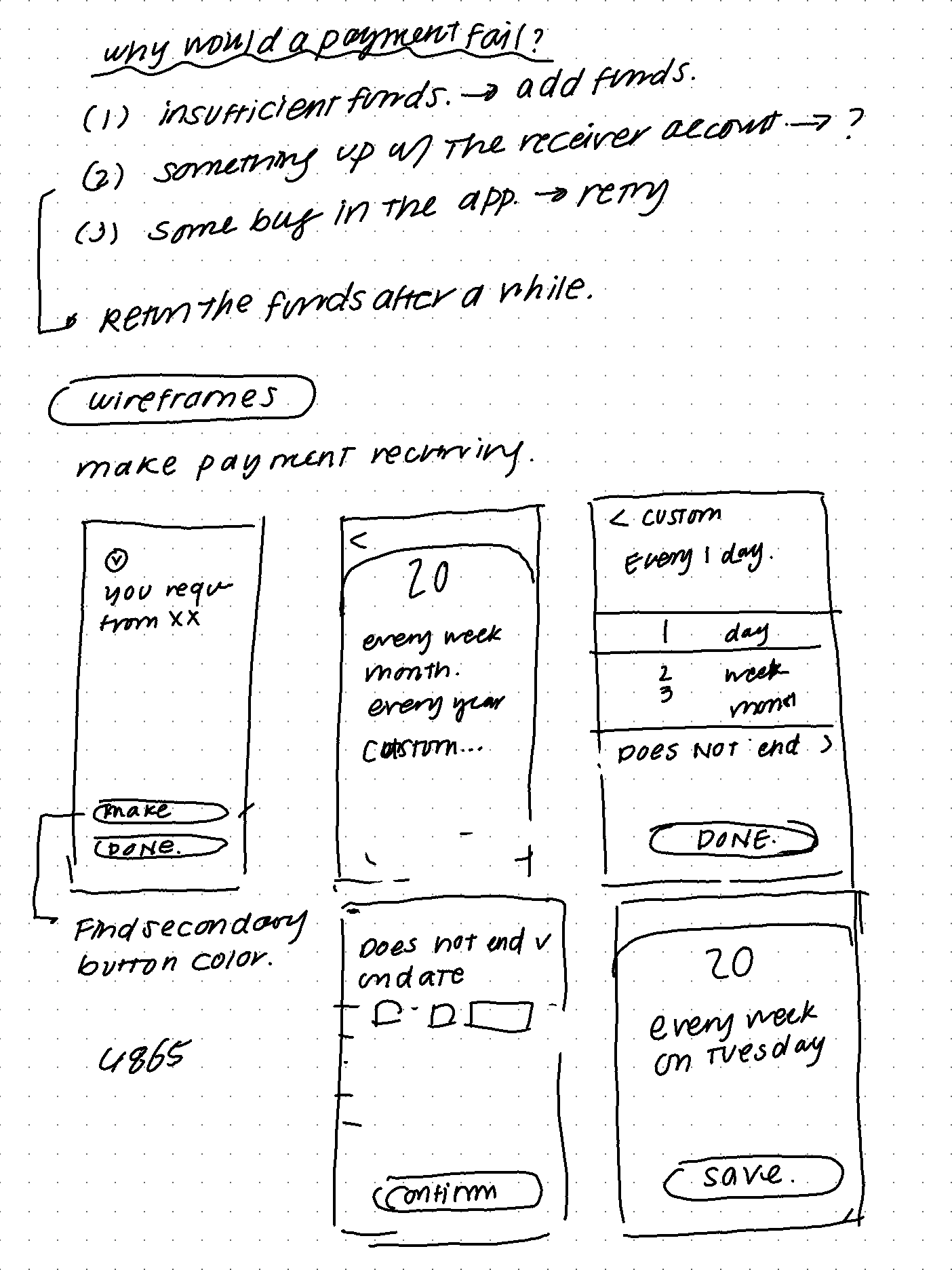

Wireframes & Prototyping

From the task flows, we sketched lo-fi wireframes. This step allows us to develop high fidelity wireframes and a prototype.

Usability Testing

A total of 8 users tested the prototype. The overall usability score is 81. This is measured through a combination of misclick rates, drop off rates, and amount of time spent on a screen.Participants were asked to complete the following tasks:

Set up a recurring payment.

Identify and skip an upcoming recurring payment.

Identify and retry a failed recurring payment.

Cancel a recurring payment series.

The only task that had a low usability scores was skipping a payment. All of the testers successfully completed this task. However, there was a high percentage of testers who misclicked (21.2%) and/or took an alternative path (37.5%) to complete the task.

After assessing the route that users did take, we might consider combining the cancel/skip and edit capabilities into a single screen for usability.

Learnings

What did we accomplish? We designed and prototyped a feature to allow users to set up recurring payments on the Cash App.

How could we improve? Given more time, we would have designed and implemented more of the features on the product roadmap, such as the ability to pay businesses in a recurring way or purchase Bitcoin periodically. Given that Cash App serves as a financial ecosystem for the traditionally underbanked, these features would undoubtedly contribute to furthering this population’s interactions with the financial world.